19+ paycheck calculator new hampshire

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for New Jersey residents only. Alabama and Nebraska set the age of majority to 19 and Mississippi sets it at 21.

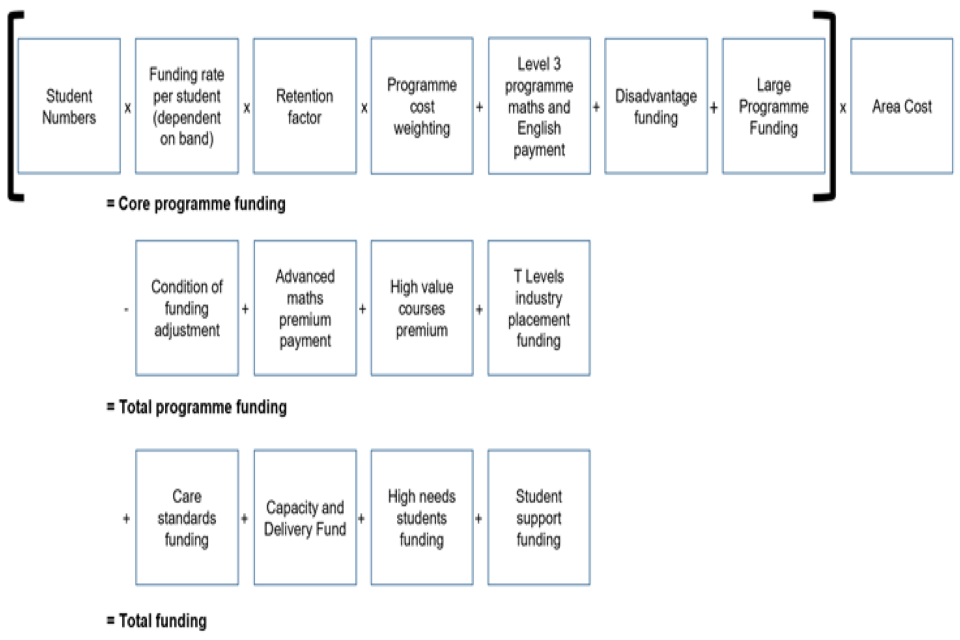

Funding Guidance For Young People 2021 To 2022 Rates And Formula Gov Uk

Start with a free eFile account and file federal and state taxes online by April 18 2022 - if you miss this deadline you have until October 17 2022.

. When an employee departs for example you may need to issue a final paycheck. In our calculator we take your home value and multiply that by your countys effective property tax rate. Your paycheck needs protection.

This is equal to the median property tax paid as a percentage of the median home value in your county. States Mississippi had the highest poverty rate in 2018 197 poverty rate followed by Louisiana 1865 New Mexico 1855 and West Virginia. Overview of New Jersey Taxes.

A 2020 or later W4 is required for all new employees. You can call 603 227-4030 or email NHDMVHelpdosnhgov. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes.

ASCII characters only characters found on a standard US keyboard. How to Fill Out W-4. The states average effective rate is 242 of a homes value compared to the national average of 107.

Other useful paycheck calculators. Home auto insurance team. The Center for American Progress is dedicated to improving the lives of Americans through progressive ideas and action.

Tax rates are expressed in mills with one mill equal to 1 of tax for every 1000 in assessed property value. Overall homeowners pay the most property taxes in New Jersey which has some of the highest effective tax rates in the country. Is a relatively tax-friendly state especially for retirees the high concentration of millionaires.

WHAT IS THE LIVING WAGE CALCULATOR. The IRS has changed the withholding rules effective January 2020. The age of legal adulthood is called the age of majority.

Personal state programs are 3995 each state e-file available for 1995. The ERC Calculator will ask questions about the companys gross receipts and employee counts in 2019 2020 and 2021 as well as government orders that may have impacted the business in 2020 and 2021. The ERC Calculator is best viewed in Chrome or Firefox.

Must contain at least 4 different symbols. 1000 per paycheck or the first 75 of disposable earnings whichever is greater is exempt from wage garnishment. New Hampshire residents also dont pay too much state tax at the pump.

Browse our listings to find jobs in Germany for expats including jobs for English speakers or those in your native language. An ebook short for electronic book also known as an e-book or eBook is a book publication made available in digital form consisting of text images or both readable on the flat-panel display of computers or other electronic devices. This exemption applies to every paycheck regardless of how often the.

The calculator on this page is focused on normal pay runs for hourly employees and their salaried counterparts but there are also a number of special situations when paychecks need a little more finagling. Checked for accuracy on 562022. It is not a substitute for the advice of an accountant or other tax professional.

This calculator is for 2022 Tax Returns due in 2023. WPRO-12 In addition to your current IRS tax withholding which is most likely based on your latest W-4 and based on your entries we suggest you withhold this additional tax amount in order to balance or reduce the taxes owed with your 2022 Tax Return. New Hampshire charges state fees and city fees with state fees based upon the weight of your vehicle.

Dont want to calculate this by hand. The state and a number of local government authorities determine the tax rates in New Hampshire. In fact rates in some areas are more than double the national average.

E-file fees do not apply to NY state returns. Homeowners in New Jersey pay the highest property taxes of any state in the country. Building on the achievements of progressive pioneers such as Teddy.

Give us a call. This is equal to the median property tax paid as a percentage of the median home value in your county. The average effective property tax rate in New Jersey is 242 compared to.

If you are a New Hampshire resident serving out-of-state please contact the DMV for instructions on how to register and title a recently purchased vehicle. New Hampshire Property Tax Rates. In the meantime view our W-4 paycheck tax calculator.

State e-file available for 1995. Most personal state programs available in January. In our calculator we take your home value and multiply that by your countys effective property tax rate.

This number is the gross pay per pay period. Calculate accurate take home pay using current Federal and State withholding rates. Numerical values are consistent with living wage 2021.

Free paycheck calculator for both hourly and salary employees. Stephanie Moser and assistance from Chet Swalina 05192022. A study taken in 2012 estimated that roughly 38 of Americans live paycheck to paycheck.

How to Fill Out W-4. Based on the data entered and the tax refund amount shown at WPRO-10 above we suggest you reduce your tax withholding to. Use our simple calculator to see if you qualify for the ERC and if so by how much.

The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Although sometimes defined as an electronic version of a printed book some e-books exist without a printed equivalent.

The PaycheckCity salary calculator will do the calculating for you. Today they have extended 14 billion in funding to. Towns school districts and counties all set their own rates based on budgetary needs.

For example New Hampshire has the lowest poverty rate of any state in the U. Use Before 2020 if you are not sure. OnDeck was founded in 2006 and has since been a leading provider in the business lending space offering both term loans and lines of credit.

Subtract any deductions and payroll taxes from the gross pay to get net pay. 6 to 30 characters long.

Payslip Templates 28 Free Printable Excel Word Formats Excel Templates Business Template Templates

Symmetry Software Offers Dual Scenario Calculators To Aid In Comparing Take Home Pay For Varying Deductions And Benefits

Employability Hub Access Southampton

Employability Hub Access Southampton

Tuition And Financial Aid Welch College

Accepted Students Next Steps Georgia State Admissions

Paycheck Calculator Take Home Pay Calculator

Free Paycheck Calculator Hourly Salary Smartasset

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Paycheck Calculator Take Home Pay Calculator

Free Online Paycheck Calculator Calculate Take Home Pay 2022

New Hampshire Hourly Paycheck Calculator Gusto

Paycheck Calculator Take Home Pay Calculator

New Hampshire Salary Calculator 2022 Icalculator

Iec Officially Announces The Election Results Steve Tshwete

Butternut Juglans Cinerea Cosewic Assessment And Status Report 2017 Canada Ca